Life Insurance in and around Bethesda

Life goes on. State Farm can help cover it

What are you waiting for?

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Young people often assume they don’t need life insurance right now. Actually, it’s the opposite! It’s much better to secure your life insurance in your 20s and 30s. That’s why your Bethesda, OH, friends and neighbors both young and old already have State Farm life insurance!

Life goes on. State Farm can help cover it

What are you waiting for?

Love Well With Life Insurance

Coverage from State Farm helps you rest easy knowing those you love will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the high costs of financially supporting children, life insurance is a vital need for young families. Even if you're a stay-at-home parent, the costs of replacing housekeeping or daycare can be sizeable. For those who aren't raising a family, you may have debt that your partner will have to pay or be planning to have children someday.

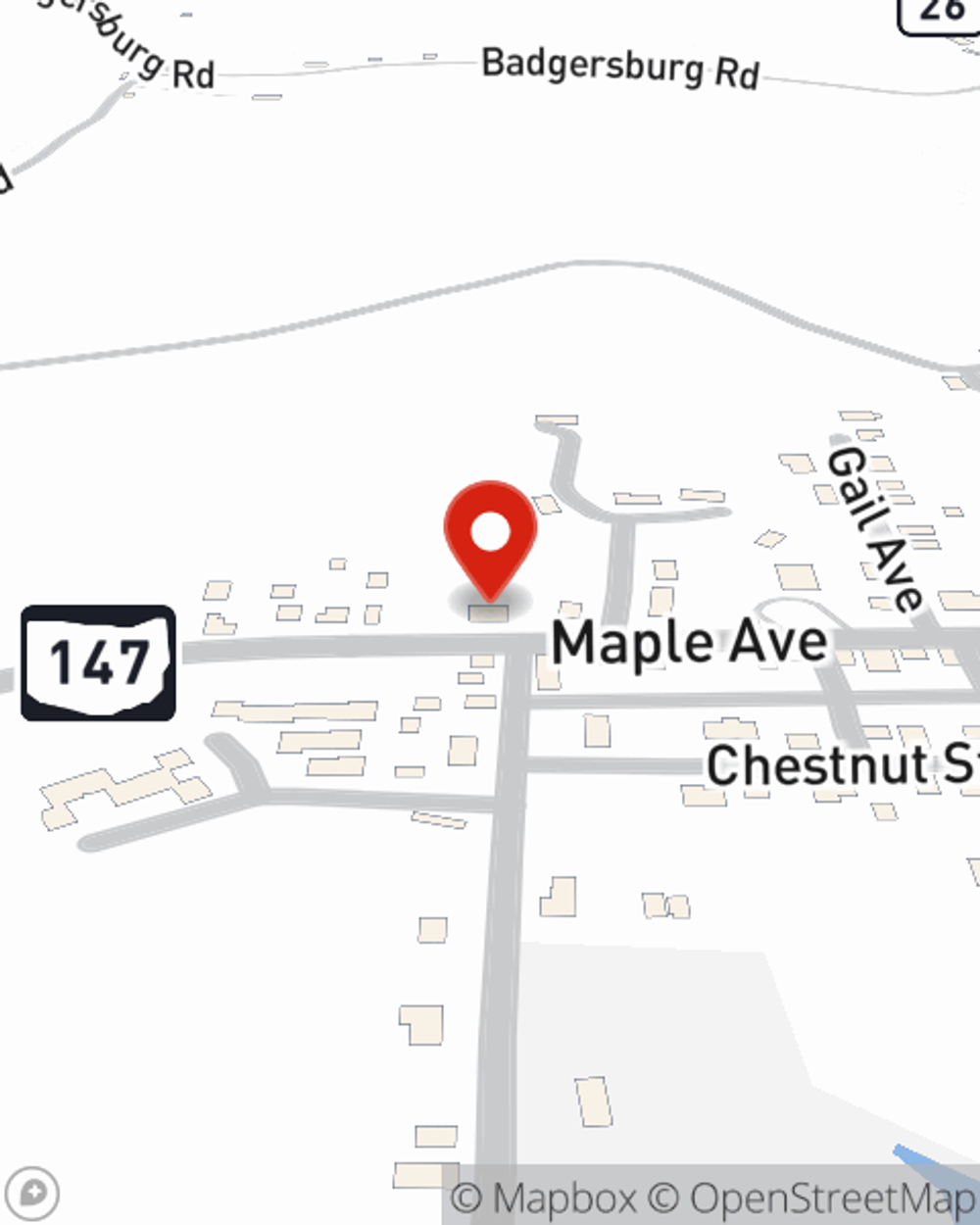

Wherever you're at in life, you're still a person who could need life insurance. Visit State Farm agent Amy Latham's office to explore the options that are right for you and those you hold dear.

Have More Questions About Life Insurance?

Call Amy at (740) 484-1233 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.

Simple Insights®

Is life insurance worth it?

Is life insurance worth it?

When deciding if life insurance is worth buying, start by looking at what's important to you and how you want to protect it.

When should I update my estate plan?

When should I update my estate plan?

Marriage, death and divorce are, of course, reasons to update an estate plan. We review other times to review what's included in this financial document.